Easy Tips to Build Up Your Credit Score | Sterling State Bank

10/17/2021

Credit – you either have it, or you don’t. It’s either good or it’s bad. But what does it mean?

What is a credit score?

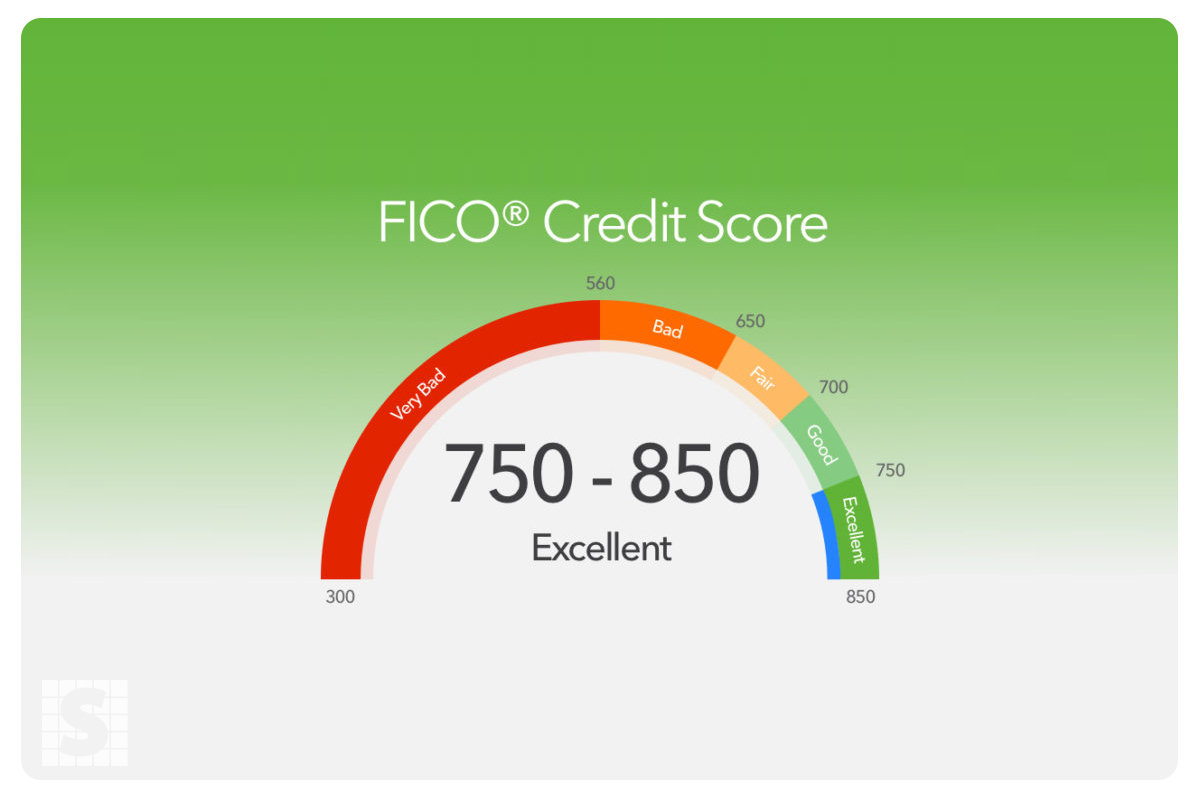

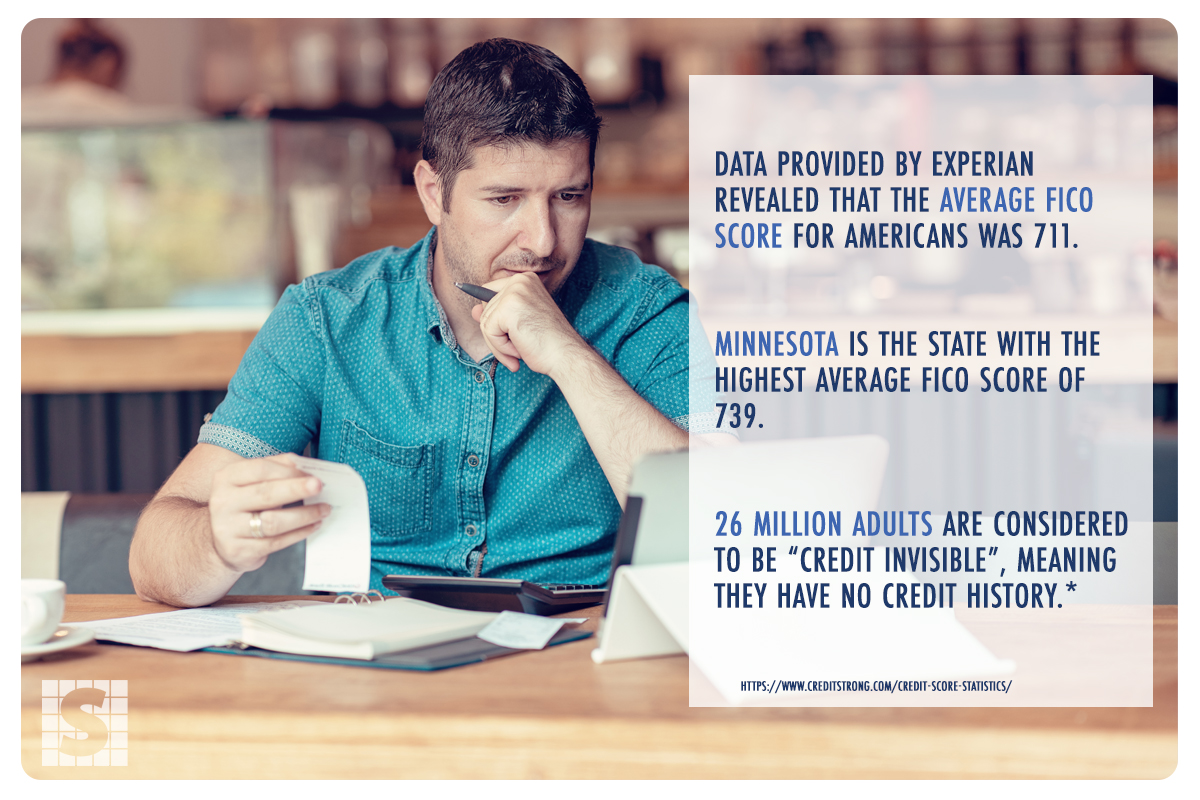

A credit score is a 3 digit number that financial institutions use to determine your ability to repay money borrowed. Credit scores are calculated from information about your credit accounts.

Believe it or not, the FICO score was not used until 1989. Credit scoring and systems were used as early as 1956, but it was not until the late 80’s that the vast majority of banks, creditors and lenders started to use this universal scoring.

Why is credit important?

Your credit can affect your ability to purchase homes, cars, or apartments. The better your credit score, the more access you get to credit products and rates. A credit score can take years to build up and just days to bring down so it is important to know your credit score and work to maintain and build it up.

7 Tips to build your credit score

-

Know your credit score

The very first thing you want to do when working on your credit score is to find out what your score is. You can do this free through various sites or mobile apps. Knowing what your score is and what is on your report give you an idea of what you need to go to work on next.

-

Pay your bills on time

This is a no brainer. The more you pay on time, the better your score will be. This shows lenders that you are trustworthy to repay money borrowed. Paying your bills on time accounts for 35% of your score ranking and holds the most weight, meaning it can sway your score quickly.

-

Build credit history.

The longer you have accounts, the more established you appear in the credit world. This accounts for 15% of your score. Paying off accounts is great, but constantly closing and opening new ones can have a slight effect on your score. Try to keep some long term accounts to maintain that longevity.

-

Credit utilization

30% of your score is determined by the amount of credit you have utilized. Best practice shows that you want to owe 30% or less of what you have as a total borrowed. For example, if you have a $10,000 limit credit card, you should try to keep your balance under $3,000. The idea here is to not owe more than you have available.

-

Become an authorized user.

This is a simple yet effective way to gain some points. Request to be an authorized user on someone’s credit card account. This does not mean you get a card or have access to that account, it simply means your name is now on the account therefore, allowing you to benefit from on time payments, balance utilization and more. This can be a great solution for a parent and child or a spouse.

-

Dispute credit report errors.

Make sure that everything on your report is accurate. If you notice something that is out of place, contact that creditor immediately to rectify the situation.

-

Have a credit mix.

Having a variety of credit items will play into 10% of your score. Having a mix like credit card, rent, and car loan can help increase your score.

https://www.myfico.com/credit-education/whats-in-your-credit-score

https://www.nerdwallet.com/article/finance/credit-score-ranges-and-how-to-improve